The Ultimate Guide To Ach Payment Solution

Table of Contents10 Simple Techniques For Ach Payment SolutionThe Ultimate Guide To Ach Payment SolutionGet This Report about Ach Payment SolutionThe Greatest Guide To Ach Payment Solution

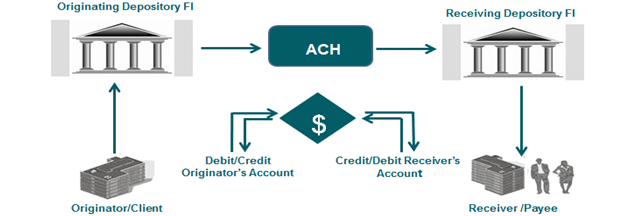

The Federal Get then types all the ACH data and afterwards routes it to the receiver's financial institution the RDFI.The RDFI after that processes the ACH files and debts the receiver's (Hyde) account with 100$. The example over is that of when Jekyll pays Hyde. If Hyde has to pay Jekyll, the very same process takes place in reverse.The RDFI uploads the return ACH data to the ACH network, in addition to a reason code for the error. A return might be processed likewise as a result of different other factors like a void account number etc. ACH payments can work as an excellent option for Saa, S services. Here are some bottom lines to keep in mind when selecting ACH for your Saa, S: Although the use of paper checks has actually gone down to a wonderful extent, lots of venture companies still use checks to pay on a monthly basis in order to prevent the huge piece of processing fees.

With ACH, because the deal handling is persisting and also automated, you would not have to wait on a paper check to get here. Since customers have actually licensed you to collect payments on their part, the adaptability of it allows you to collect single settlements. No extra awkward emails asking customers to compensate.

Credit card settlements stop working because of numerous factors such as run out cards, obstructed cards, transactional errors, and so on. In some cases the consumer can have surpassed the credit score limitation and also that can have brought about a decrease. In case of a bank transfer by means of ACH, the savings account number is used together with a consent, to charge the client and unlike card deals, the possibility of a financial institution transfer failing is really reduced.

How Ach Payment Solution can Save You Time, Stress, and Money.

Account numbers seldom alter. Unlike card purchases, financial institution transfers stop working just for a handful of factors such as insufficient funds, wrong bank account details, and so on. The two-level confirmation process for ACH repayments, ensures that you maintain a touchpoint with customers. This consider for spin because of unidentified reasons.

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)

This safe procedure makes ACH a trustworthy option. If you're taking into consideration ACH, head below to know how to accept ACH debit payments as an on the internet service. For each bank card deal, a percent of the cash entailed is split throughout the numerous entities which enabled the payment (ach payment solution). A significant portion of this cost is the Interchange fee.

In instance more information of a deal routed using the ACH network, considering that it straight deals with the financial network, the interchange charge is around 0. 5-1 % of the overall purchase.

The 8-Minute Rule for Ach Payment Solution

For a $10,000 purchase, you will pay (0. The fee for a common ACH deal ranges somewhere around 0. The actual TDR (Purchase Price Cut Price) for ACH varies according to the payment portal used.

Smaller transfer costs (usually around $0. 50 per transaction)Bigger purchase fees (2. 5% to 3. 2% per transaction)Payments are not automated, Automated settlements, Take even more time, Take much less time, Refine extensive and also thus not as simple to use, Easy to use, ACH costs less and also is of fantastic value to merchants however the obstacle is getting a a great deal of customers onboard with ACH.

They charge high quantity (even more than $1000) users with just $30 level cost for limitless ACH transactions. You can drive boosted fostering of ACH settlements over the long term by incentivizing consumers using rewards and benefits.

ACH transfers are digital, bank-to-bank cash transfers refined via the Automated Clearing Up Full Article House (ACH) Network. According to Nacha, the organization in charge of these transfers, the ACH network is a batch processing system that financial institutions and also other financial institutions usage to accumulation these transactions for handling. ACH transfers are electronic, bank-to-bank money transfers processed via the Automated Cleaning House Network.

How Ach Payment Solution can Save You Time, Stress, and Money.

Direct repayments include cash heading out of an account, consisting of expense repayments or when you send money to another person. ach payment solution. ACH transfers are practical, fast, and also frequently free. You may be limited in the number of ACH deals you can start, you may incur extra costs, as well as there might be hold-ups in sending/receiving funds.

7% from the previous year. Person-to-person and business-to-business transactions likewise raised to 271 million (+24. ACH transfers have several usages and can be extra cost-efficient as well as easy to use than composing checks or paying with a credit history or debit card.

Comments on “All About Ach Payment Solution”